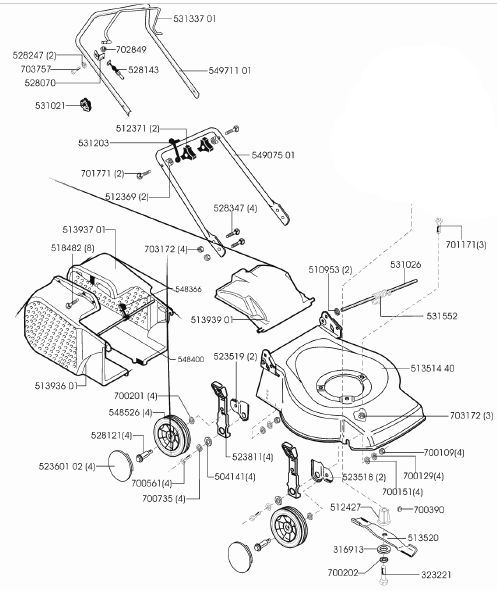

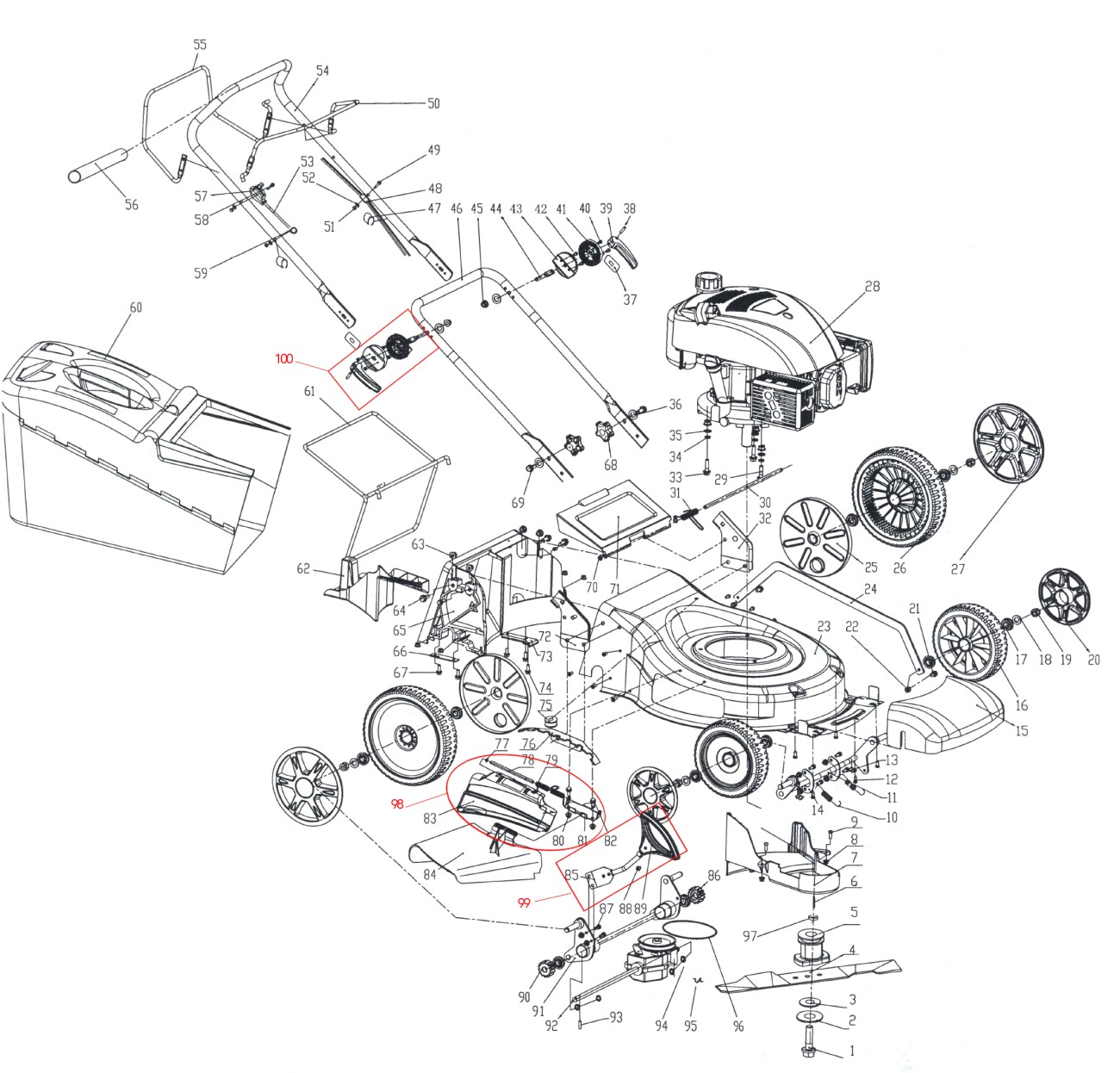

4418 VARI-590H - SEKAČKY VARI - NÁHRADNÍ DÍLY | VARI - Internetový obchod zahradní techniky a náhradních dílů

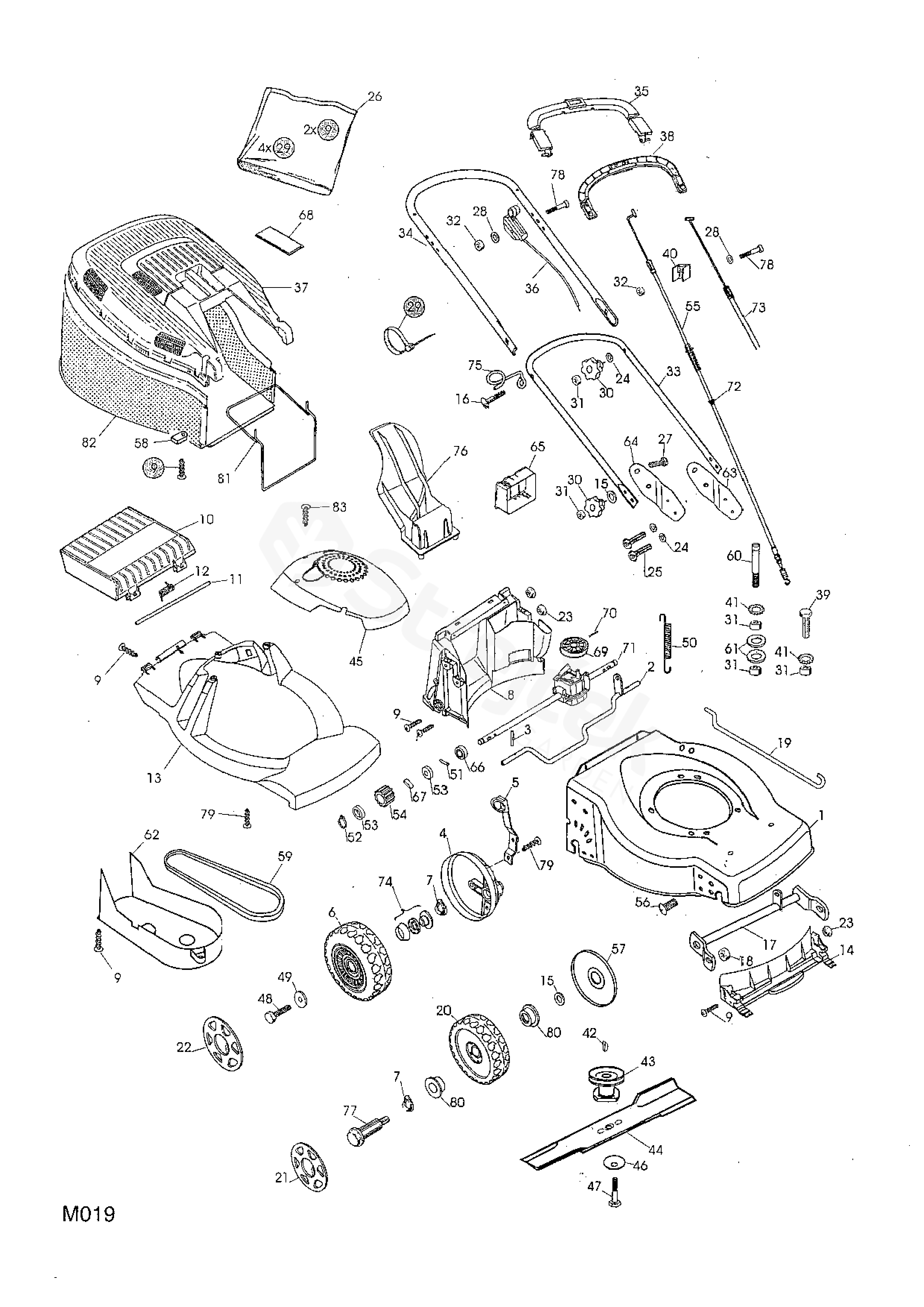

AL-KO na BROJIR.EU. Prodej sekaček AL-KO, servis a náhradní díly na AL-KO Zahradní technika AL-KO, autorizovaný prodej a servis.Náhradní díly AL-KO. Benzinové sekačky s pojezdem AL-KO .Elektrické sekačky AL-KO.Čerpadla,vodárny AL-KO.Vertikutátor AL-KO ...

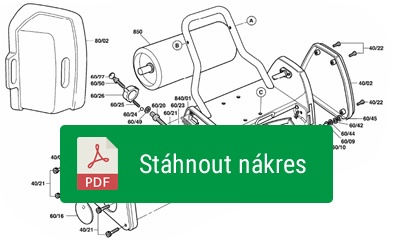

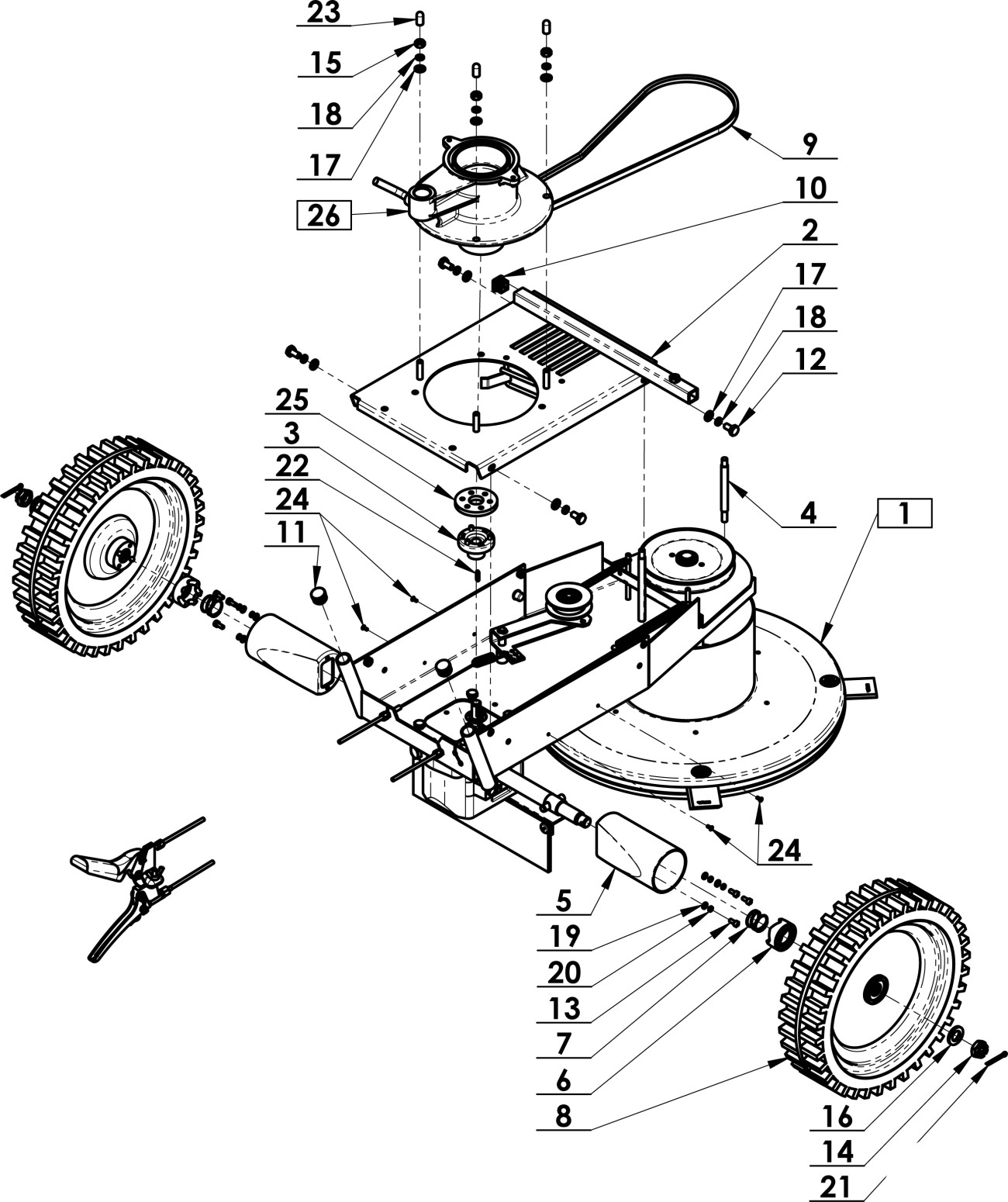

Sekačka bubnová BDR-600.2 (list3) - 1298565194 - 4139 BDR-600.2 - SEČENÍ - NÁHRADNÍ DÍLY | VARI - Internetový obchod zahradní techniky a náhradních dílů