OBRAZY NA ZAKÁZKU, NA MÍRU — Obrazy na plátně. Online galerie originálních ručně malovaných obrazů a olejomaleb na prodej. Moderní malované obrazy – současné umění. Český malíř obrazů Doris Tesárková Oplová (Edward Wolf)

OBRAZY NA ZAKÁZKU, NA MÍRU — Obrazy na plátně. Online galerie originálních ručně malovaných obrazů a olejomaleb na prodej. Moderní malované obrazy – současné umění. Český malíř obrazů Doris Tesárková Oplová (Edward Wolf)

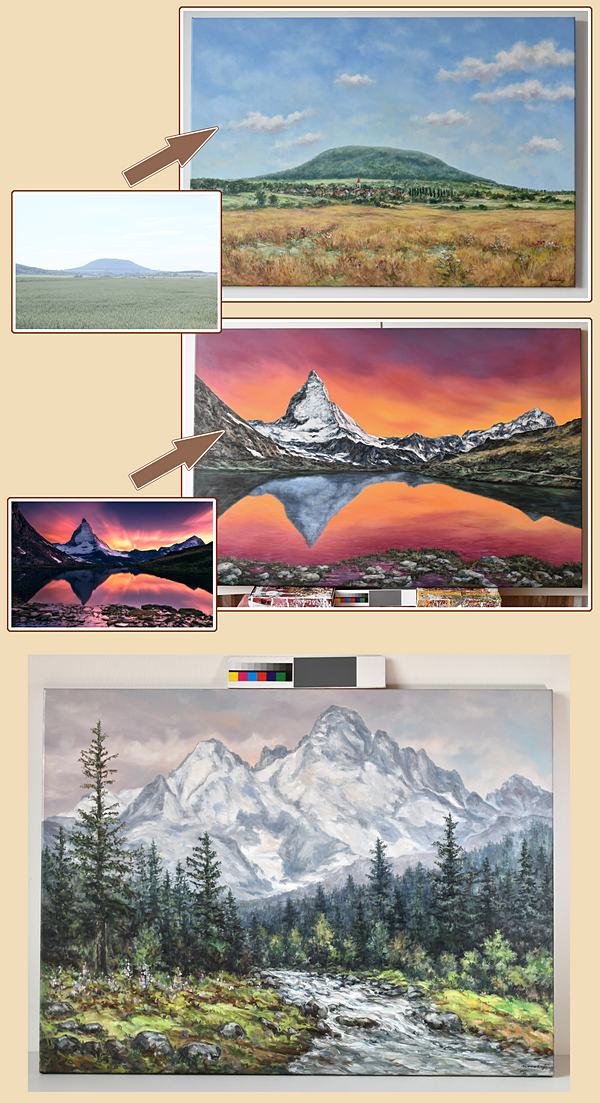

MILOŠ NOVOTNÝ: obrazy na přání, malba na přání, portréty podle fotografie, obrazy na zakázku, obraz podle fotografie, obrazy na zeď

MILOŠ NOVOTNÝ: obrazy na přání, malba na přání, portréty podle fotografie, obrazy na zakázku, obraz podle fotografie, obrazy na zeď

MILOŠ NOVOTNÝ: obrazy na přání, malba na přání, portréty podle fotografie, obrazy na zakázku, obraz podle fotografie, obrazy na zeď

MILOŠ NOVOTNÝ: obrazy na přání, malba na přání, portréty podle fotografie, obrazy na zakázku, obraz podle fotografie, obrazy na zeď