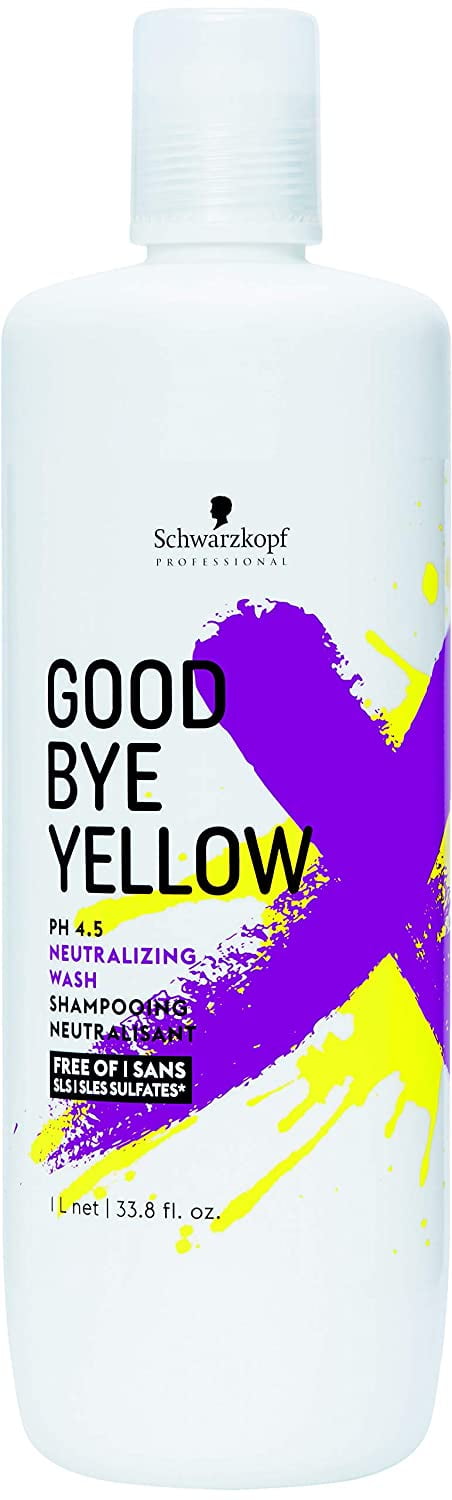

Amazon.com: GOODBYE YELLOW Neutralizing Wash Shampoo – Color Balancing for Brassy and Yellow Tones – Cleansing Vegan Hair Care with Purple and Blue Pigments, 10.1oz : Beauty & Personal Care

Amazon.com: GOODBYE YELLOW Neutralizing Wash Shampoo – Color Balancing for Brassy and Yellow Tones – Cleansing Vegan Hair Care with Purple and Blue Pigments, 10.1oz : Beauty & Personal Care

Amazon.com: GOODBYE YELLOW Neutralizing Wash Shampoo – Color Balancing for Brassy and Yellow Tones – Cleansing Vegan Hair Care with Purple and Blue Pigments, 10.1oz : Beauty & Personal Care

Schwarzkopf Goodbye Yellow Shampoo | Schwarzkopf Shampoo | Schwarzkopf Professional – Eastern Beauty Supply

💜Are your clients BEGGING for their brass to BE GONE? Send them home with GOODBYE YELLOW neutralizing purple shampoo! "The name of the shampoo says it... | By Schwarzkopf Professional | Facebook

Schwarzkopf Professional Goodbye Yellow Neutralizing Shampoo - Sulfate-Free Anti-Yellow Shampoo | MAKEUP

Amazon.com: GOODBYE YELLOW Neutralizing Wash Shampoo – Color Balancing for Brassy and Yellow Tones – Cleansing Vegan Hair Care with Purple and Blue Pigments, 10.1oz : Beauty & Personal Care

Amazon.com: GOODBYE YELLOW Neutralizing Wash Shampoo – Color Balancing for Brassy and Yellow Tones – Cleansing Vegan Hair Care with Purple and Blue Pigments, 10.1oz : Beauty & Personal Care