Růžové společenské šaty s výšivkou Chi Chi London Fatima Chi Chi London Společenské, plesové a večerní šaty | Blanka Straka

Ružové šaty Chi Chi London Krizia - Šaty na stužkovú ružové - saty na stuzkovu - spoločenské šaty na

Růžové společenské šaty Chi Chi London Cemile Chi Chi London Společenské, plesové a večerní šaty | Blanka Straka

Růžové společenské šaty Chi Chi London Cemile Chi Chi London Společenské, plesové a večerní šaty | Blanka Straka

Světle růžové společenské šaty Chi Chi London Petria Chi Chi London Společenské, plesové a večerní šaty | Blanka Straka

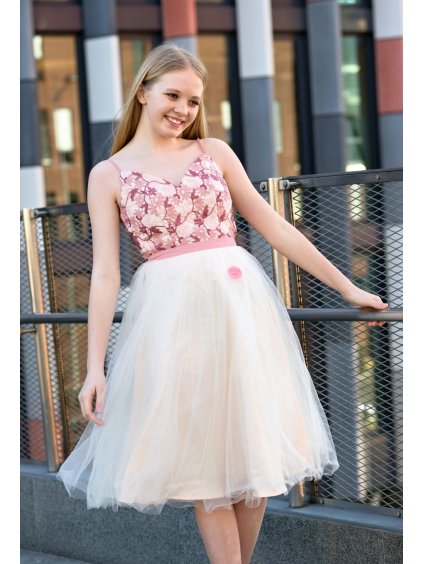

Společenské šaty s růžemi Chi Chi London Karlene Chi Chi London Společenské, plesové a večerní šaty | Blanka Straka